Weekly Mortgage Rate Update (June 12th, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

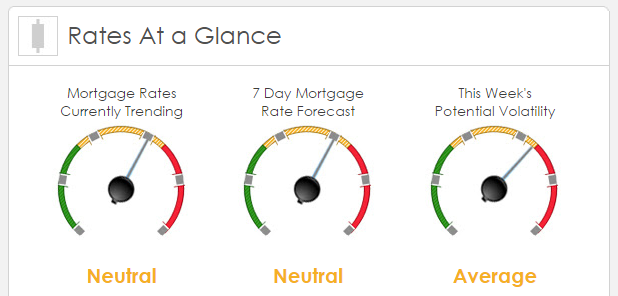

Rates Currently Trending: Neutral

Mortgage backed securities (FNMA 3.50 MBS) lost -20 basis points (BPS) from last Friday’s close which caused fixed mortgage rates to move slightly higher from the prior week. The market saw its lowest rates on Tuesday and its highest rates on Friday.

This Week's Rate Forecast: Neutral

Central Banks: Obviously, all eyes will be on our Federal Reserve but we also have Central Bank rate decisions and policy announcements from the Bank of England (5th largest economy) and Bank of Japan (3rd largest economy).

Our Federal Open Market Committee (FOMC) will begin meeting on Tuesday and will conclude Wednesday at 2:00 PM EDT. The following is the schedule:

2:00 EDT. Release of their Interest Rate Decision and Policy Statement

2:00 EDT. Release of their Economic Projections and Dot Plot Chart

2:30 EDT. Fed President Janet Yellen live press conference.

While most bond traders publicly say that they expect a 25 BPS rate hike at this meeting, it doesn’t seem to be fully priced in. That is mostly because long bond traders have significantly walked back their expectations for a 3rd hike this year. Their forward guidance (dot plot chart) and Yellen’s live comments will have more of an impact on our MBS pricing than a rate increase by itself.

Treasury Auctions this Week:

06/12 10-year note

06/13 30-year bond

Domestic: We have a huge week for economic data with the focus on inflationary data (PPI and CPI) and Retail Sales.

Geopolitical: We still have a lot of uncertainty in Great Britain as their new government attempts to gain some sort of majority and direction. Qatar and the Saudis appear deadlocked into more conflict, and at home we have more Senate testimony (Attorney General Sessions to testify) and the state of Maryland has filed a lawsuit against Trump.

This Week’s Potential Volatility: Average

We start our day with our FNMA coupon rollover. We expect Monday to trade in the +12 to -12 BPS range (net of the rollover). For the week, we expect MBS to end the week at a slightly lower level than Monday’s open (higher rates). In order for rates to move lower, the following would have to happen: The Fed does not increase the Federal Funds rate on Wednesday OR they signal that there will be no more rate hikes this year, along with comments from Yellen indicating a low likelihood of additional rate hikes this year. The greatest likelihood is that we will see MBS continue to drift slightly lower (higher rates). Although MBS are under pressure, geopolitical fear provides a “floor” for MBS.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.