Weekly Mortgage Rate Update (July 17th, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

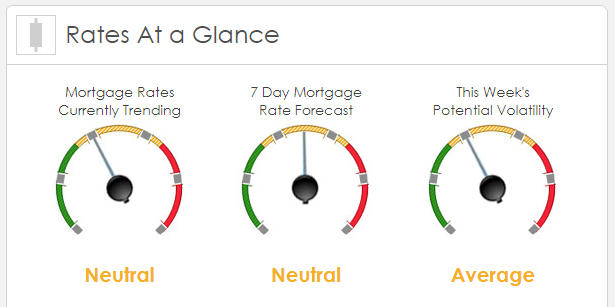

Rates Currently Trending: Neutral

Mortgage rates are trending sideways so far today. Last week the MBS market improved by +20bps. This was enough to slightly improve mortgage rates or fees. The market experienced relatively low volatility.

This Week's Rate Forecast: Neutral

Three Things: These are the three areas that have the greatest ability to impact mortgage rates this week: 1) Central Bank, 2) Geopolitical and 3) Across the Pond.

1) Central Bank: While we await our own Fed next week, we have two important Central Bank meetings this week. Both on Thursday. The Bank of Japan will hit first in the early morning, important to watch but the markets are not anticipating anything new from them. The biggest event of the week is the European Central Bank policy statement that same morning. This one has some wiggle room. President Mario Draghi made some comments two weeks ago about being close to a point where start to pull back on their bond purchases. This actually started two straight weeks of long bond sell-offs (higher rates). The market will react swiftly to any “hawkish” commentary or policy change from the ECB.

2) Geopolitical: The second round of Brexit Talks starts this week will dominate the markets internationally. Domestically, Health Care and Tax Reform will get the most attention. It looks like for now Health Care is stuck, but it also looks like momentum and efforts are shifting to getting Tax Reform moving forward. Reduced taxes will be a significant economic stimulus.

3) Across the Pond: We get some very big releases from the top 5 economies. China – Retail Sales and GDP, Germany – PPI, Eurozone – CPI, Great Brittan – CPI and PPI, Japan – Imports/Exports.

This Week's Potential Volatility: Average

There’s not a lot of economic data coming out this week that will likely move mortgage rates. Thursday, we could see some volatility due to ECB policy statement noted above.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.