Weekly Mortgage Rate Update (December 5th, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

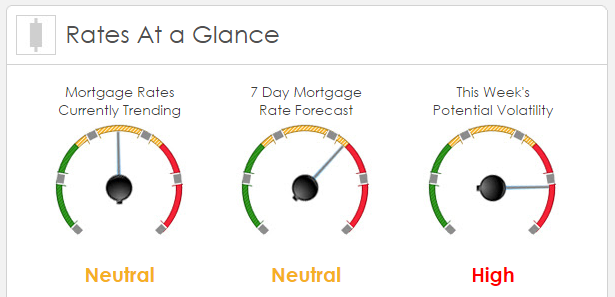

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market worsened by -9bps. This was not enough to worsen mortgage rates or fees. Mortgage rates changed very little last week, but intraday movement and volatility was high.

This Week's Rate Forecast: Neutral

Three Things: The following are the three most important events that have the greatest ability to influence mortgage rates this week: 1) European Central Bank, 2) ISM Services and 3) Oil

1) European Central Bank (ECB): On Thursday we will get their latest interest rate decision and policy statement followed up with a live press conference with ECB President Mario Draghi. Of interest to bond traders is any change or extension in their bond buying program. This program is set to expire in March. The ECB had been letting the market think (through leaks from policy makers) that they were considering “tapering” (lowering the monthly amount of bond purchases) over the next couple of months until the program ended or extending it past March and tapering a little each month. But with the Italian vote this weekend, will they extend it completely and/or increase it?

2) Domestic Flavor: We have a very light week for economic data. The most important data point will be today’s ISM Non-Manufacturing reading. The reading came in at 57.2 Vs. est. of 55.3. This is a very solid reading and is negative for mortgage rates.

3) Oil: Oil Prices are on the move again with Brent Crude briefly breaking above $55 for the first time in 16 months and WTI Oil is above $52. IF, WTI can break above $55, then that will be very negative for mortgage rates. IF WTI can break back below $50, then that is very positive for mortgage rates.

Fed: We get our last dose of Fed speak today as they enter their “black out” period prior to next week’s Fed meeting.

New York Fed President William Dudley said it is premature for the central bank to consider adjusting its rate-hike plan following Donald Trump’s U.S. presidential win and that “assuming the economy stays on this trajectory, I would favor making monetary policy somewhat less accommodative over time by gradually pushing up the level of short-term interest rates.”

Chicago Fed President Charles Evans said that while the U.S. labor market is “kind of tight,” wage growth is slow and inflation is still too low.

We will hear from St. Louis Fed President James Bullard this afternoon.

Eurozone: Their Retail Sales were stronger than expected, rising 1.1% (vs est of 0.9%) on a MOM basis and 2.4% on a YOY basis. Also, the Markit PMI for November showed expansion with a reading of 53.9 which just missed the consensus estimates of 54.1.

This Week's Potential Volatility: High

This week we have a very light week for economic data that’s likely to move mortgage rates. However, ever since Trump won the election we’ve seen mortgage rates continue to head higher in a very choppy market.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.