Weekly Mortgage Rate Update (August 8th, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

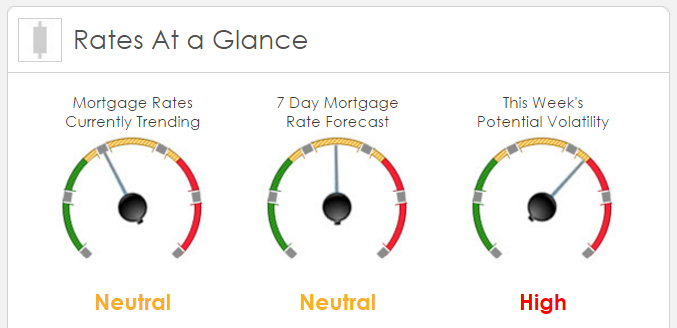

Rates Currently Trending: Neutral

Mortgage rates are trending unchanged this morning. Last week the MBS market worsened by -21 bps. This was enough to worsen mortgage rates or fees. The MBS market was volatile last week.

This Week’s Rate Forecast: Neutral

Three Things: These three items will have the greatest potential to drive mortgage rates this week: 1) Global Economic data, 2) A Glut of Debt hitting the market and 3) Domestic Economic data.

1) Global Economic Data: This week we get both PPI and CPI out of China as well as Retail Sales and Industrial Production. Out of Germany, we get CPI, 2nd QTR GDP, and Industrial Production.

2) A Glut of Debt – Treasury Auctions this week: (How the market do, absorbing so much long term debt all at once?) 08/09 U.S. 3 year note, Great Britain 30 year bond. 08/10 U.S. 10 year note, Germany 10 year bond. 08/11 U.S. 30 year bond, Great Brittan 10 year bond.

3) Domestic Economic Data: The biggest report of the week will be Friday’sRetail Sales data. But also of note is Unit Labor costs , Wholesale and Business Inventories, PPI and Consumer Sentiment. Oil: WTI Oil was briefly under $40 two weeks ago and now is above $42.60. While there is still an oversupply of oil and economists’ models showing a global slowdown which will cause a higher oversupply, this is being offset by some OPEC members calling for a restrain in output. This is giving oil a lift. If it breaks above $44, then it will pressure mortgage rates.

This Week’s Potential Volatility: High

We’re looking for relatively low volatility today and increased volatility tomorrowand throughout the week. Retail sails numbers on Friday are likely to cause increased volatility.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them