Weekly Mortgage Rate Update (August 7th, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

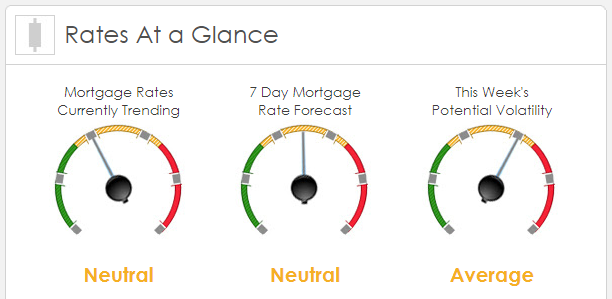

Rates Currently Trending: Neutral

Mortgage rates are trending sideways this morning. Last week the MBS market improved by -+22. This was may’ve been enough to improve mortgage rates or fees. Mortgage rates were volatile toward the end of the week.

This Week’s Rate Forecast: Neutral

Three Things: These are the three items that have the greatest ability to impact mortgage rates this week: 1 ) Fed, 2) Inflation and 3) Across the Pond.

1) Fed: We will hear from several key voting members this week. We will be paying close attention to the overall theme of the timing of starting their MBS taper this year.

- 08/07 James Bullard and Neel Kashkari

- 08/09 Charles Evans

- 08/10 William Dudley

- 08/11 Robert Kaplan

2) Inflation: We get both PPI and CPI this week. The market is expecting PPI YOY to get back above 2.0%. However, that is not expected to flow through to Friday’sCPI which is expected to hit 1.8%. The closer Friday’s CPI data is to 2.0%, the worse it is for mortgage rates. The closer that reading is to 1.5%, the better it is for mortgage rates.

3) Across the Pond: We get some important economic data out of the world’s second largest economy as we get China’s Import and Export data as well as their PPI and CPI. We also get key data from Japan (number 3 economy), Germany (number 4) and Great Brittan (number 5).

Treasury Auctions This Week: (The 10 and 30 are not new auctions but reauctions of current debt).

- 08/08 3 year note

- 08/09 10 year note

- 08/10 30 year bond (most important)

Rounding Third: The bond market will also be paying close attention to Tuesday’sOPEC meeting as well as geopolitical events. The United Nations voted 15-0 on Saturday to impose new and harsher sanctions on North Korea which will cripple its exports (and therefore the cash flow into the nation that would be presumably used for nuclear research). This has put concerns over a trade war between China and the U.S. at ease for the time being.

This Week's Potential Volatility: Average

Mortgage rates are likely to be fairly stable through the first part of the week. However, we could see some volatility when we start getting inflation numbers on Wednesday and through the rest of the week.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.