Weekly Mortgage Rate Update (August 22nd, 2016) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

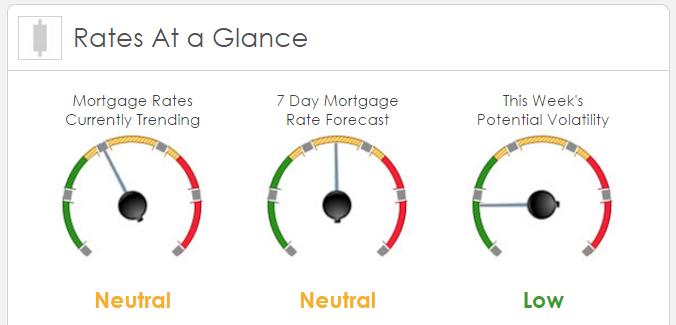

Rates Currently Trending: Neutral

Mortgage rates are trending unchanged this morning. Last week the MBS market was essentially unchanged. The MBS market was fairly calm last week.

This Week’s Rate Forecast: Neutral

These are the three items that will influence bond pricing the most this week: 1) The Talking Fed, 2) Oil and 3) Domestic Flavor.

Fed: The annual Jackson Hole (WY) Economic Policy Symposium put on by the Federal Reserve Bank of Kansas City is the most important event of the week. We will hear from a bevy of Feds and economists Thursday and Friday but we will hear specifically from Janet Yellen on Friday at 11EST and that will get the most attention from traders. New York Federal Reserve President William Dudley is the third most important person in the FOMC (1 – Yellen, 2- Fischer). So, when he talks the markets listen. Last week during an interview he made it very clear that a September rate increase is very much on the table. He said that the elections won’t weigh on the Fed and said that “the market is complacent about the need to gradually hike rates and the time for a rate hike is edging closer.” He also noted that the market’s reaction to the “Brexit” was rather short lived.

Oil: Oil shot up four bucks last week on comments out of Saudi Arabia that they would support some level of production limits at the next OPEC meeting which caused downward pressure on MBS prices and higher mortgage rates. But this week, we open to a different bias on oil prices as China is exporting more refined products, U.S. rig counts are up for the 8th straight month and it looks like Iraq and Nigeria are dumping supply. As a result, WTI Oil prices are trending lower which is positive for mortgage rates.

Domestic Numbers: Our economic data will be largely steam rolled by Fed comments but we still do have an important Durable Goods Orders report and a revised 2nd QTR GDP release. We round out our data with New Home Sales and Existing Home Sales.

This Week’s Potential Volatility: Low

We expect mortgage rates to be in a bit of a holding pattern until Thursday’sDurable Goods Orders and Janet Yellen’s speech on Friday.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.