Weekly Mortgage Rate Update (April 23rd, 2017) Hagerstown, MD Real Estate

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up. Tracking these securities real-time is critical. For more information about the rate market, contact me directly. I’m among few mortgage professionals who have access to live trading screens during market hours.

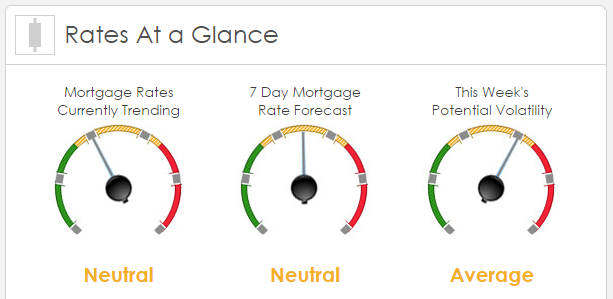

Rates Currently Trending: Neutral

Three Things: These are the three areas that have the greatest potential to impact mortgage rates this week. 1) Central Bank 2) U.S. politics and 3) Domestic.

1) Central Bank: The focus will be on Thursday as we hear from both the Bank of Japan and the European Central Bank. From the ECB side, we want to know more about the amounts and timing of their reduced monthly bond purchases (started in March). Also, their economic data has been very strong as of late, and it will be interesting to hear how President Mario Draghi addresses future rate plans. For the BofJ, we will be looking to see if they move off of their negative interest rate position.

2) U.S. Politics: As Congress returns from a two-week break, it’s “game on” this week. Of note, is Wednesday’s announcement from President Trump on more details of his proposed tax levels. The administration has walked backed expectations on the level of detail that will be in this announcement, but any clarity on what he is going to push through could have a significant impact on mortgage rates. We also are facing yet another government shutdown deadline on Saturday which is also his 100th day in office. Defunding of Obama care and budget changes will be key negotiations this week. And of course, during all of this, it appears that they are getting prepared to make another run at healthcare reform.

3) Domestic Flavor: This week we have some strong economic releases that for a change could influence mortgage rates. The focus will be on Thursday’s Durable Goods Orders Ex-Transports as a proxy for business/capital spending. Next up will be Friday’s GDP data where we get a first look at the first QTR GDP.

Treasury auctions this week:

- 04/25 2 year note

- 04/26 5 year note

- 04/27 7 year note

Fed: We hear from Neel Kashkari (yet again) and then we enter the “blackout period” where the Fed is prohibited from speaking until the May 2-3 FOMC meeting.

This Week's Potential Volatility: Average

We expect mortgage rates to be relatively stable today, but this week we could see some volatility. The markets will be paying close attention to the government shutdown, tax cuts, ECB and the strength of the US GDP.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.